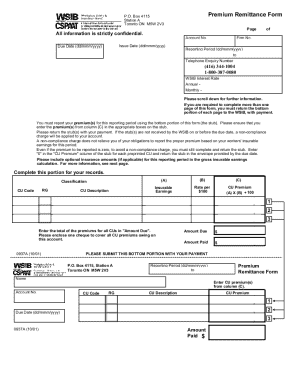

Ontario WSIB Form 1009A 2010-2026 free printable template

Show details

P.O. Box 4115 Station A Toronto ON M5W 2V3 All information is strictly confidential. Print reset Reconciliation Form Original Issue Date (dd/MMM/YYY) Due Date (dd/MMM/YYY) Page Start Account No. Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign printable wsib form

Edit your wsib blank reconciliation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wsib 1009 a form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing get 1009a ontario make online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1009a wsib claim get form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1009a wsib login form

How to fill out Ontario WSIB Form 1009A

01

Obtain a copy of the Ontario WSIB Form 1009A from the WSIB website or your workplace.

02

Carefully read the instructions provided with the form to understand what information is required.

03

Fill out your personal information, including your name, address, and contact information in the designated sections.

04

Provide details about the incident, such as the date, time, and location of the injury or illness.

05

Describe the nature of the injury or illness in detail, including how it occurred.

06

List any witnesses to the incident if applicable, including their contact information.

07

Sign and date the form to certify that the information provided is accurate and complete.

08

Submit the completed form as directed, either electronically or by mail to the WSIB.

Who needs Ontario WSIB Form 1009A?

01

Employees who have suffered a workplace injury or illness are required to fill out the Ontario WSIB Form 1009A to report their situation.

02

Employers may also need the form for their records and to facilitate the reporting process on behalf of employees.

Fill

wsib form 9

: Try Risk Free

People Also Ask about wsib reconciliation form fillable

Where do I put 1099a on my tax return?

How Do I Report Form 1099-A on My Tax Return? The information found on the form must be included on Schedule D of Form 1040. Calculate your gains or losses by subtracting the purchase price for the property (minus any improvements you made) from the fair market value listed on 1099-A.

Can I use a 1099a to buy a car?

“Property” means any real property (such as a personal residence), any intangible property, and tangible personal property except the following. (such as a car) held only for personal use. However, you must file Form 1099-A if the property is totally or partly held for use in a trade or business or for investment.

What is 1099 NEC?

More In Forms and Instructions Use Form 1099-NEC to report nonemployee compensation.

Who is required to receive a 1099?

The 1099 form is used to report non-employment income to the Internal Revenue Service (IRS). Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year.

Do I need to report 1099-A on my tax return?

Your mortgage lender will fill out and file Form 1099-A with the IRS. They'll also send a copy to all of the borrowers listed on that foreclosed loan. Each borrower must then report the information from the form on their personal tax returns.

What is a 1099a form used for?

Acquisition or Abandonment of Secured Property On Form 1099-A, the lender reports the amount of the debt owed (principal only) and the fair market value (FMV) of the secured property as of the date of the acquisition or abandonment of the property.

Why would you use a 1099a?

File Form 1099-A for each borrower if you lend money in connection with your trade or business and, in full or partial satisfaction of the debt, you acquire an interest in property that is security for the debt, or you have reason to know that the property has been abandoned.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my m5w reconciliation issue fill in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your wsib forms pdf and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit wsib forms in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your wsib fax number ontario, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out wsib registration ontario on an Android device?

Use the pdfFiller app for Android to finish your wsib travel expense form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is Ontario WSIB Form 1009A?

Ontario WSIB Form 1009A is a document used by employers to report workplace injuries and illnesses to the Workplace Safety and Insurance Board (WSIB) in Ontario.

Who is required to file Ontario WSIB Form 1009A?

Employers in Ontario who have employees covered by the WSIB must file Form 1009A to report any workplace injuries or illnesses that occur.

How to fill out Ontario WSIB Form 1009A?

To fill out Form 1009A, employers should provide detailed information regarding the injured employee, description of the injury or illness, date and time of incident, and any medical treatment provided.

What is the purpose of Ontario WSIB Form 1009A?

The purpose of Form 1009A is to ensure that the WSIB is informed of workplace injuries and illnesses, facilitating the provision of benefits to injured workers and enabling the WSIB to monitor workplace safety.

What information must be reported on Ontario WSIB Form 1009A?

The information that must be reported includes the employer's and employee's details, a description of the incident, the nature of the injury or illness, and any relevant medical information.

Fill out your Ontario WSIB Form 1009A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wsib Form 6 is not the form you're looking for?Search for another form here.

Keywords relevant to wsib login

Related to wsib expense forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.