Ontario WSIB Form 1009A 2010-2024 free printable template

Show details

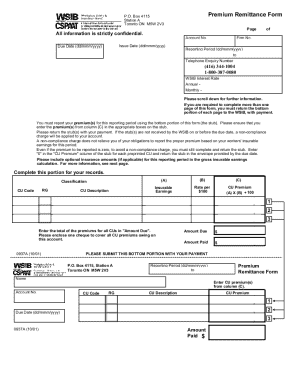

P.O. Box 4115 Station A Toronto ON M5W 2V3 All information is strictly confidential. Print reset Reconciliation Form Original Issue Date (dd/MMM/YYY) Due Date (dd/MMM/YYY) Page Start Account No. Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your wsib reconciliation form 2023 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wsib reconciliation form 2023 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wsib reconciliation form 2023 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1009a form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out wsib reconciliation form 2023

How to fill out 1009a?

01

Start by gathering all the necessary information and documents required for the form.

02

Begin filling out the personal information section, such as your name, address, and contact details.

03

Provide any additional details or qualifiers, if applicable, such as your social security number or taxpayer identification number.

04

Proceed to the income section, where you will need to disclose your sources of income, including salaries, wages, dividends, or any other relevant financial information.

05

If you have any dependents, indicate their information in the appropriate section of the form.

06

Depending on your specific circumstances, you may need to fill out the deductions and adjustments section, reporting any eligible deductions or credits.

07

Make sure to thoroughly review the completed form for accuracy and completeness before submitting it.

Who needs 1009a?

01

Individuals who need to report their income and any related information to the appropriate tax authorities.

02

Anyone who has received income from various sources and needs to report it for taxation purposes.

03

Individuals who have dependents and need to provide their information for tax calculations.

04

Those who may be eligible for certain deductions or credits and require the 1009a form to claim them.

Note: It is always recommended to consult with a tax professional or refer to the specific guidelines provided by the relevant tax authorities to ensure accuracy and compliance when filling out the 1009a form.

Fill 1009a ontario reconciliation sample : Try Risk Free

People Also Ask about wsib reconciliation form 2023

Where do I put 1099a on my tax return?

Can I use a 1099a to buy a car?

What is 1099 NEC?

Who is required to receive a 1099?

Do I need to report 1099-A on my tax return?

What is a 1099a form used for?

Why would you use a 1099a?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1009a?

1009a is a section of the United States Internal Revenue Code which states that any taxpayer who is liable for a tax due must file a return on or before the due date.

What is the purpose of 1009a?

Section 1009a of the Internal Revenue Code (IRC) provides rules regarding the taxation of certain “qualified distributions” from qualified tuition programs (QTPs). These distributions are exempt from federal income tax and allow individuals to use funds from their QTPs to pay for qualified higher education expenses such as tuition, fees, books, supplies, and equipment.

What information must be reported on 1009a?

Form 1099-A must include the following information:

1. The name, address, and taxpayer identification number of the borrower

2. The name and taxpayer identification number of the lender

3. The date of the foreclosure or repossession

4. The fair market value of the property

5. The amount of debt discharged

6. Any known related expenses or costs

Who is required to file 1009a?

Form 1009A does not exist. However, the most similar form is called Form 1099-A. Form 1099-A is typically filed by the lender or financial institution when a borrower has had a debt canceled, foreclosed property, or had a property transferred to them due to a default on a loan. It reports the acquisition or abandonment of secured property by the borrower.

How to fill out 1009a?

To fill out Form 1099-A, follow these steps:

1. Obtain a copy of the Form 1099-A from the IRS website or request it from the relevant financial institution.

2. Fill out the recipient's information: Provide the recipient's name, address, and taxpayer identification number (TIN) in Boxes 1 and 2. If the recipient is a company, use its employer identification number (EIN). If it is an individual, use their social security number (SSN).

3. Provide the date of the lender's acquisition or knowledge of abandonment of the property in Box 1. This is the date when the lender took back or became aware of the abandoned property.

4. Enter a description of the property in Box 2. Provide a brief description of the property, such as residential real estate, commercial property, or other relevant details.

5. Indicate whether the borrower was personally liable for repayment of the debt using the checkboxes in Box 4. If the borrower was personally liable, check the appropriate box; if not, leave it blank.

6. Provide the fair market value (FMV) of the property in Box 5. This is the value of the property on the date of acquisition or knowledge of abandonment. You may need to consult an appraisal or expert opinion to determine the FMV.

7. In Box 6, report the outstanding principal balance of the debt at the time of acquisition or abandonment. This is the remaining amount of the loan owed by the borrower.

8. Complete Box 7 by checking the appropriate box for the reason the lender is filing this form. Generally, it will be "1" for acquisition or abandonment.

9. Sign and date the form in the appropriate fields at the bottom of the page.

10. Ensure that you keep a copy of the completed Form 1099-A for your records.

Please note that while these instructions provide a general overview, specific requirements and circumstances may vary. It is always advised to consult with a tax professional or the IRS for specific guidance related to your situation.

When is the deadline to file 1009a in 2023?

There is no specific form called "1009a," so it is unclear what you are referring to. If you mean Form 1099-A, which reports information about the acquisition or abandonment of secured property, the deadline for filing it with the IRS is typically January 31st of the year following the calendar year of the acquisition or abandonment. However, please note that tax deadlines may change, so it is advisable to check with the IRS or a tax professional for the most up-to-date information.

How do I modify my wsib reconciliation form 2023 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your 1009a form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit wsib reconciliation form fillable in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your wsib reconciliation form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out wsib remittance form pdf on an Android device?

Use the pdfFiller app for Android to finish your get wsib 1009a blank form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your wsib reconciliation form 2023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wsib Reconciliation Form Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to wsib remittance form

Related to wsib reconciliation form 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.